| Translate This News In |

|---|

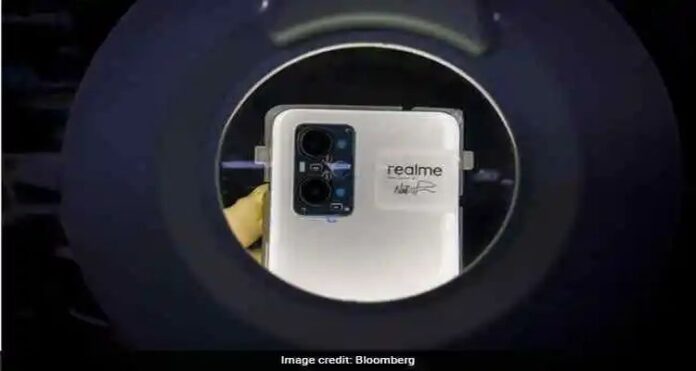

When a global chip scarcity forced many phone manufacturers to delay launches last year, upstart Chinese brand Realmuto took a risk in India. With processors from global players such as Qualcomm Inc. in short supply, Realme decided to purchase them from a relatively unknown Shanghai manufacturer in order to continue producing new handset models.

The gamble paid off, propelling the four-year-old newcomer to third place in the fast-growing market of approximately 600 million smartphone users. In the most recent quarter, only Samsung Electronics Co. and Xiaomi Corp. sold more devices in India, with Realme closing in.

Realme has emerged as a power in the lucrative but perilous Indian market, where even global brands such as Apple Inc. have struggled with regulatory hurdles. And, as the two nuclear-armed nations clash politically, Prime Minister Narendra Modi’s government has increased its scrutiny of Chinese firms in recent months.

Nonetheless, Realme has managed to escape the government crackdown unscathed. All of the smartphones it sells in India are manufactured in the country, which boosts local employment. And Realme is assisting India in bringing new users online with its Android smartphones that really can cost less than $100, a fraction of the price of iPhones and more expensive Samsung models.

“What I want to do is bring more affordability to the India market,” Realme India CEO Madhav Sheth said in an interview at a coffee shop near the company’s local headquarters on New Delhi’s outskirts. According to him, Realme complies with all Indian regulatory obligations and believes in working with authorities.

Realme’s relatively smooth sailing contrasts sharply with the difficulties encountered by its larger competitors. Apple had to fight the government for years just to open general merchandise stores in the country, and it also had a protracted battle with authorities over a spam-detection app built by the government that accesses users’ call logs.

This year, the government started cracking down on market leader Xiaomi, with an anti-money-laundering agency threatening to seize more than $700 million from the Chinese company, causing concern among India’s fledgling electronics industry.

“Investing in India remains slightly risky for foreign companies because policies change without adequate notice,” said Shumita Deveshwar, senior director at equity investment consultancy TS Lombard. “India has also encouraged local companies to grow, but sometimes the country’s politics make it an uncertain battleground, particularly for foreign investors.”

Realme has capitalised on rivals’ challenges by expanding its distribution to over 40,000 stores and bringing assertively priced devices such as last year’s 13,999 rupee ($180) Realme 8 5G, which was the cheapest fifth-generation wireless device at the time. According to Tarun Pathak of tech researcher Counterpoint, such tactics have did help it eat into Xiaomi and Samsung’s market share in India.